In a year which has seen Jimmy Carr morally rebuked for using the ‘K2’ tax avoidance system and the likes of Starbucks, Amazon and Google are coming under intensive scrutiny for avoiding corporation tax, the High Court has made a landmark ruling that could make it easier for property owners to avoid paying empty business rates, writes Roger Reid of Haslams.

Businesses have historically been afforded relief through the tax system when their commercial property stood empty. Business rates were waived for three months and charged at 50% thereafter to give businesses time to make a decision on what to do with a property and provide relief while sales went through or capital was raised to refurbish. Industrial properties were fully exempt.

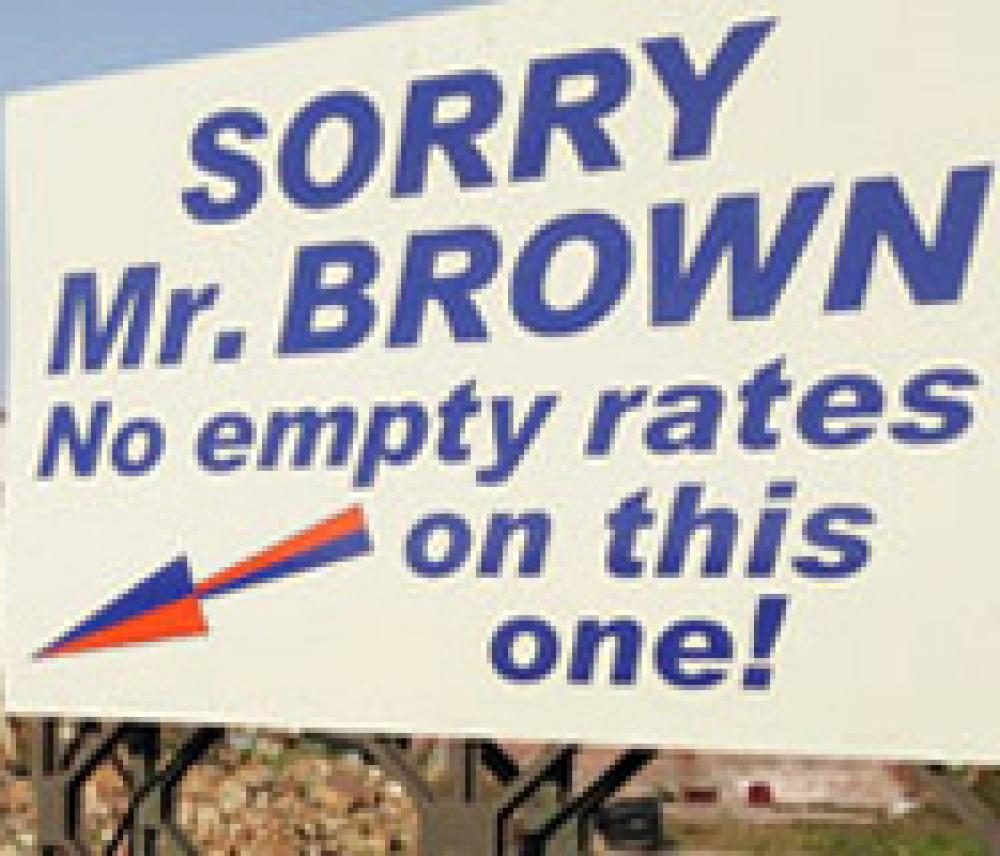

But controversially in the budget of 2007 the then Chancellor Gordon Brown announced that the Government was scrapping this relief as part of the Rating (Empty Properties) Act 2007. Non-industrial property would be exempt from business rates for three months and industrial properties six months. After that time business owners reverted to paying full rates. The intention of this controversial policy was to try and reduce the amount of time a commercial property lay vacant by incentivising landlords to reduce rents. In reality the measure has led to a wide spread reduction in supply due to demolition of existing stock by landlords and an understandable reluctance for developers to speculatively develop new stock. So contrary to the original stated objective of the Government, the reduction in supply has actually led to higher rents in some areas. With improving market conditions, particularly in the industrial sector this is a situation that is likely to be compounded.

The consequences of this ‘stealth tax’ have been far reaching as many predict that recovery from the downturn will be slower as SME’s will have a smaller choice of affordable accommodation, that is if the much anticipated green shoots of recovery ever work out which way is up!

Interestingly, the Conservative and Liberal Democrats were on the property industry’s side in vehemently opposing the empty rates bill when it came in to force. They were highly critical of the tax which Vince Cable branded as “ludicrous, completely counterproductive and economically very damaging”. David Cameron branded Labour as the “enemy of enterprise” over the decision.

On this evidence one could be forgiven for believing that when the Coalition Government came in to power that things would start looking up for landlords and developers and that the tax would be scrapped. But nearly two and a half years in to the new regime and despite high profile campaigns by the British Property Federation, Estates Gazette and Property Week – to name but a few – they have persevered with the tax. What’s more, they have taken an even more aggressive stance by removing small business rates relief on properties with a rateable value of £18,000 and under. This was designed to help small business owners to survive the recession. To remove the relief will have a detrimental effect on employment levels and impact economic recovery whilst only netting the Treasury a relatively modest £300 million per annum extra.

Whilst demolition has been widespread a less extreme way in which landlords and business owners have tried to avoid the tax is to test the Courts definition of ‘empty’.

A landmark case this Summer has changed the landscape for the property industry. The case involved cash and carry firm Makro’s use of just 0.2% of the floor space of a 140,000 sq ft warehouse in Coventry to store documents. Originally the Magistrates Court found that the degree of occupation of the building by Makro was ‘de minimis’ and did not amount to lawful occupation, but Makro successfully appealed the decision in the high court. They ruled that the storage of sixteen pallets of documents was enough to trigger a 6 month “marketing relief” period once the pallets were removed.

This ruling is perhaps a victory for common sense and has set an interesting precedent for surveyors, property managers and local authorities. I expect this will open the floodgates for more rate payers to partially occupy their premises to enable them to qualify for additional rate free periods.

The empty business rate tax was thought out when the property market was performing relatively strongly. However since its inception the market has performed poorly and it is now acting as a major barrier to a recovery. The higher vacancy has boosted treasury coffers but the property industry is convinced that this is small beer compared to the economic damage it is causing. As the vast majority of commercial property is owned either directly or indirectly by pension funds the Government’s perseverance with this tax is not good news for us, the public, who will ultimately pay the majority of empty business rates.

If you need any property advice please give Haslams a call.

Added by

Tanya Le Sueur